Bright Plan Management Services

The simple, stress free way to make the most of your NDIS plan.

Bright Plan Management Services

The simple, stress free way to make the most of your NDIS plan.

NDIS plan manager

Because something in your life should be easy…

If you’re an NDIS participant, or your child is, you already have plenty of challenges to face.

Bright Plan Management Services can help with one very important part of that – managing your NDIS funds.

As an NDIS registered plan management provider, we look after paying provider invoices, claiming back expenses and tracking your funds. So you can be sure you spend your NDIS funds wisely, within the guidelines.

And it won’t cost you a cent!

About Us

Bright Plan Management Services is a registered plan management provider, specialising in NDIS plan management service and nothing else.

We’re here to help.

- Experts in managing money and budgets

- Prompt and accurate payment processing

- Quick response to any questions

- Can manage complex cases with multiple budgets in one plan

- Instant visibility of what NDIS funding you have used and what is still available

- Proactive communication to build trust and good working relationships

Book a time to talk about your NDIS plan management needs

Why use an NDIS Plan Manager?

Simply put, using a plan manager gives you the most freedom to choose your service providers, with the minimum paperwork and admin for you. Even better, it doesn’t cost you anything.

If you work with a proactive plan manager like Bright Plan Management Services, you also get expert advice and support from someone who understands the NDIS and how it works.

Some people are also uncomfortable with technology. If that’s you, you may prefer talking to a plan manager to get updates about your plan, instead of logging on to the NDIA myplace portal.

Options for managing your NDIS plan

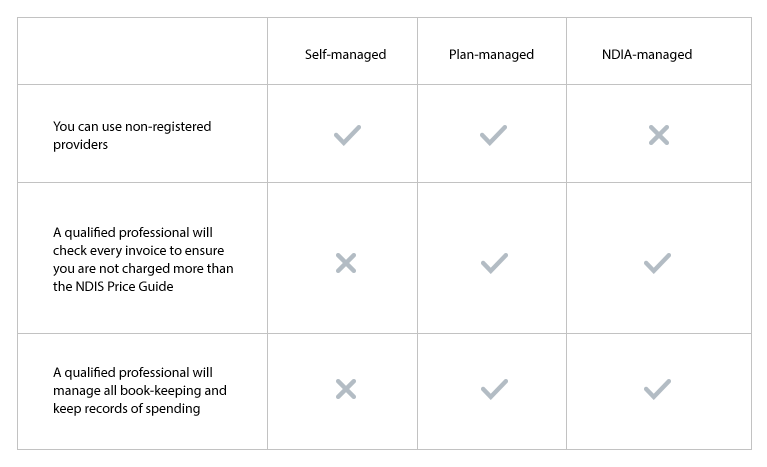

NDIS participants have three options for how to manage the funds allocated to them.

Whichever option you choose, you can

- Choose which providers you want to use

- Use any provider registered with the NDIS

- Negotiate pricing to get more value from your NDIS funds

- Log onto the myplace portal to see your plan and track your budget

But there are also differences between the options.

How the NDIS plan management options are different

1. Using non-registered providers

Large businesses which do lots of work with NDIS participants are registered.

But smaller service providers, or ones who don’t work much with NDIS participants, may not be registered.

Depending on the services you need and where you live, you may find you want to use non-registered providers. If so, you will need to use a plan manager like Bright Plan Management Services, or manage your funds yourself.

The NDIS Price Guide sets standard prices for the services in your plan. Some providers may charge more than these standard prices.

You may want to use a provider even though they are more expensive. In this case, you will get less of whatever service they provide, or you will have to pay the extra cost yourself. This is only possible if you manage your plan yourself.

If you use an NDIS plan management company like ours, we will only pay invoices which match the NDIS Price Guide. We check this every time. You can be sure you will have enough NDIS funds to cover the full amount of service included in your plan.

3. Bookkeeping and financial records relating to your plan

There must be accurate financial records for every NDIS plan. If you self-manage, all the work of this data entry and reporting will be your responsibility.

Alternatively, you can appoint a plan manager like Bright Plan Management Services to look after your funds for you – or you can ask the NDIA to do it. This means there is no admin burden for you to deal with.

Even better, there is no cost to you of having a plan manager or the NDIA look after your plan. The costs are paid by the NDIA.

Should you use an NDIS Plan Manager?

You can choose whichever option is best for your circumstances. Many NDIS participants choose a plan manager, because

- you get a wide choice of service providers

- all the financial management is done for you

- you don’t have to pay for the plan manager

What do NDIS plan managers do?

There are many NDIS plan managers you can choose to work with.

The main work for any of them is to look after all the financial administration of your NDIS plan. That means things like:

- receiving invoices, either directly from your service providers or forwarded from you

- checking and paying those invoices

- making claims via the NDIS portal

- doing all the financial reporting which is legally required

- keeping track of your budget, so you can use all your funds without overspending

You can still choose which service providers you want to use.

Some plan managers (like Bright Plan Management Services) will also help with:

- general advice about the NDIS and how it works

- reviewing the rates charged by your service providers to ensure they are in line with the latest NDIS Price Guide

We meet regularly with all our clients to make sure they are using their plan effectively.

Choosing the best NDIS Plan Manager for you

There are many things to consider when choosing a plan manager.

Financial Capability

First, it’s important to have someone who knows all about budgeting, accounting and financial reporting. At Bright Plan Management Services, our team are qualified accountants and bookkeepers, so you know you’re in safe hands with this.

If your NDIS plan has several components, your plan manager will track funds and spending for each area separately.

Communication

Whether your plan is complex or relatively straightforward, you should expect regular updates to make sure you are on track.

Look for someone who is friendly and responsive. Someone who answers the phone or returns calls quickly. Someone who replies to emails.

The best NDIS plan manager will have good relationships with your providers as well as with you. They need to pay providers promptly, or contact them proactively if there is a problem.

At Bright Plan Management Services, we plan meetings for the whole year when we start managing your plan. We are easily available by phone during office hours, and will arrange extra meetings if there is something we need to discuss.

Independence

The best NDIS plan manager will always make you the first priority. Some plan managers work for companies which offer other NDIS services. This is not a problem in itself, but it may be harder for them to give impartial advice about which service provider to use.

At Bright Plan Management Services, the only thing we do is NDIS plan management, so we have no conflict of interest. Our aim is to be the best NDIS plan manager we can – for each and every client.

Contact Us

Ready to take the stress out of your NDIS plan management?

Are you a first time NDIS participant?

Having a bad time with another plan manager?

Or just tired of doing it all yourself?

Whichever it is, we’d love to help.

Let’s organise a first meeting where you can experience the Bright Plan Management Services difference for yourself!

Email: isil@brightplan.net.au